Free GST Number Verification

-

Name of the business

-

Address of the Business

-

Additional Place of Business

-

State Jurisdiction

-

Center Jurisdiction

-

Date of registration

-

Type of business

-

HSN Codes associated

-

GSTIN status - Active / Canceled

-

Date of Cancellation (if applicable)

-

Compliance Status

-

Last 12 month Compliance Status

What is a GST Identification Number (GSTIN)/GST Number?

GSTIN or Goods and Services Tax Identification Number is a unique 15 digits alpha-numeric PAN-based code allotted to every registered person under Goods and Service Tax. This number is provided to the GST taxpayer along with the GST registration certificate, and the number also allows tracking of a registered Taxpayer. The GSTIN search Check feature helps to perform GST verification and Know your GST in India with the help of the HSN code.

Why GSTIN Verification with SignalX Matters

-

Unique 15-digit GSTIN helps identify and track registered businesses

-

Confirms authenticity of suppliers, vendors, and partners

-

Prevents fraud, fake GST numbers, and tax evasion

-

Enables accurate GST return filing and valid ITC claims

-

Reduces risk of penalties and financial losses

-

Helps businesses stay compliant with GST laws

-

Quick and reliable GST number validation via SignalX

-

Builds trust and transparency in business transactions

Run Struck Off Companies Checks in Bulk. Try Bulk Upload.

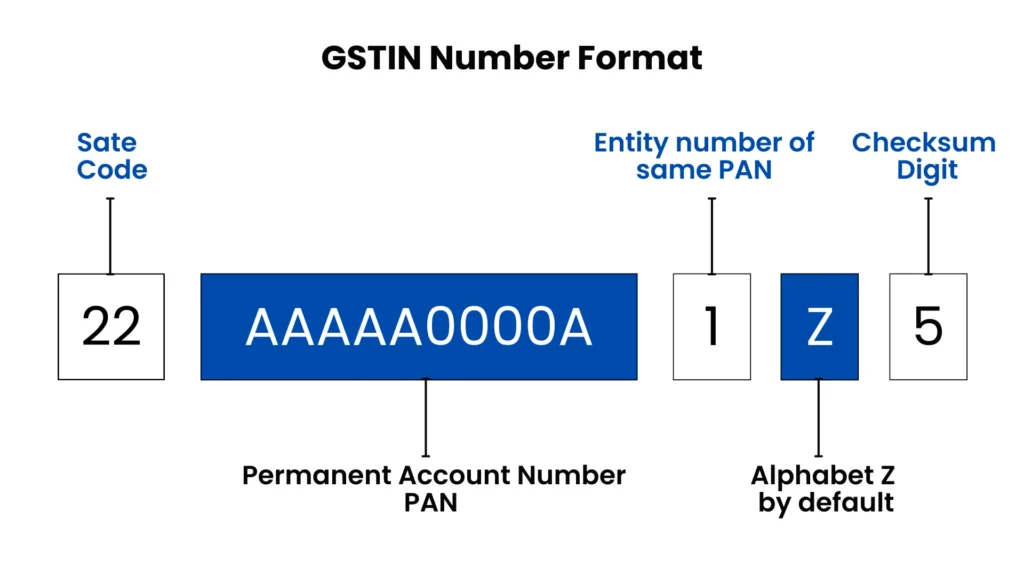

GSTIN Format – Understanding the 15 Digits

1st–2nd digits: State code

3rd–12th digits: PAN number of the entity

13th digit: Number of registrations under the same PAN in a state

14th digit: Default value “Z”

15th digit: Check code (used for error detection)

Search Smarter: Validate Businesses Before They Enter Your Vendor List

-

Name of the business

-

Address of the Business

-

Additional Place of Business

-

State Jurisdiction

-

Center Jurisdiction

-

Date of registration

-

Type of business

-

HSN Codes associated

-

GSTIN status - Active / Canceled

-

Date of Cancellation (if applicable)

-

Compliance Status

-

Last 12-month Compliance Status

How to Use SignalX GST Verification Tool

Validate any GST Number in Seconds

Follow these simple steps:

-

Visit the SignalX GSTIN Search Page

-

Enter the GSTIN you wish to verify in the search bar

-

Click ‘Search’ and get instant verification results

✅ GSTIN Verification in 3 Easy Steps

- Go to the SignalX GST search page

- Type in the GSTIN number

- Click on the search button

🚨 Report Fake GST Bill or Invoice

- Online: Visit cbec-gst.gov.in → CBEC MITRA Helpdesk → “Raise Web Ticket”

- Email: cbecmitra.helpdesk@icegate.gov.in

- Twitter: @askGST_GoI and @FinMinIndia

One-time checks are great. But your Business needs more.

FAQs

Every entity registered under GST is provided with a unique 15-digit identification number from the concerned tax authorities. This number is provided with the purpose of collecting tax on behalf of the government and accessing input tax credits.

A GSTIN number can also be used to perform GST verification in order to validate the authenticity of a registered company or business.

A person can easily fetch details about a company from their GST number. Following the steps to get started.

- Go to the page: signalx.ai/gst-verification/

- Enter the whole GSTIN number and click on the search

- Get the details pertaining to the GST holder instantly.

All the goods-providing businesses whose annual turnover exceeds Rs. 40 Lakhs in a financial year are subjected to getting registered under the GST as a normal taxable entity. States such as Jammu and Kashmir, Himachal Pradesh, Uttarakhand, and North Eastern States of India are subjected to get registered with the threshold of Rs 20 lakh annual turnover.

All the services-providing businesses whose annual turnover exceeds Rs. 20 Lakh in a financial year are to be registered under GST as normal taxpayers. Except for Jammu and Kashmir, Himachal Pradesh, Uttarakhand, and the North Eastern States of India, the annual turnover threshold is Rs. 10 Lakhs.

HSN stands for Harmonised System of Nomenclature. The HSN Code was introduced in the year 1988 by WCO for the systematic classification of goods all over the world.

HSN is a 6-digit code that classifies each individual good. HSN codes are applicable to Customs and GST. The HSN code is used all over the world, every commodity has different HSN codes. Filing GST returns is simplified when HSN codes are used, since no details about the goods need to be uploaded separately.

Form GSTR 3B is a simplified summary return. In this return, the taxpayers are required to declare their summary GST liabilities for a particular period and discharge these liabilities.

For every taxpayer, it is mandatory to fill the Form GSTR 3B returns for every tax period. Form GSTR 3B can be filled out from the returns section of the GST portal.

- Log in with your credentials in the Online GST Portal,

- Go to Services > Returns > Returns Dashboard.

- Select the financial year and tax period, Form GSTR-3B, (if applicable), in the given period, will be displayed.

In case of no business, taxpayers are required to file for Form GSTR 3B as nil return (as no outgoing and incoming transactions are performed within that tax period)

The due date for filing Form GSTR-3B by monthly filers is the 20th day of the month following the month to which the return pertains.

Quarterly filers should submit Form GSTR-3B by the 22nd or 24th of the month following the quarter for which the return is filed, as notified by different states/UTs.

However, the due date for filing Form GSTR-3B can be extended by Government through notification.