Data Analysis & Risk Terminal

Smarter Due Diligence Backed by 100M+ Verified Data Points

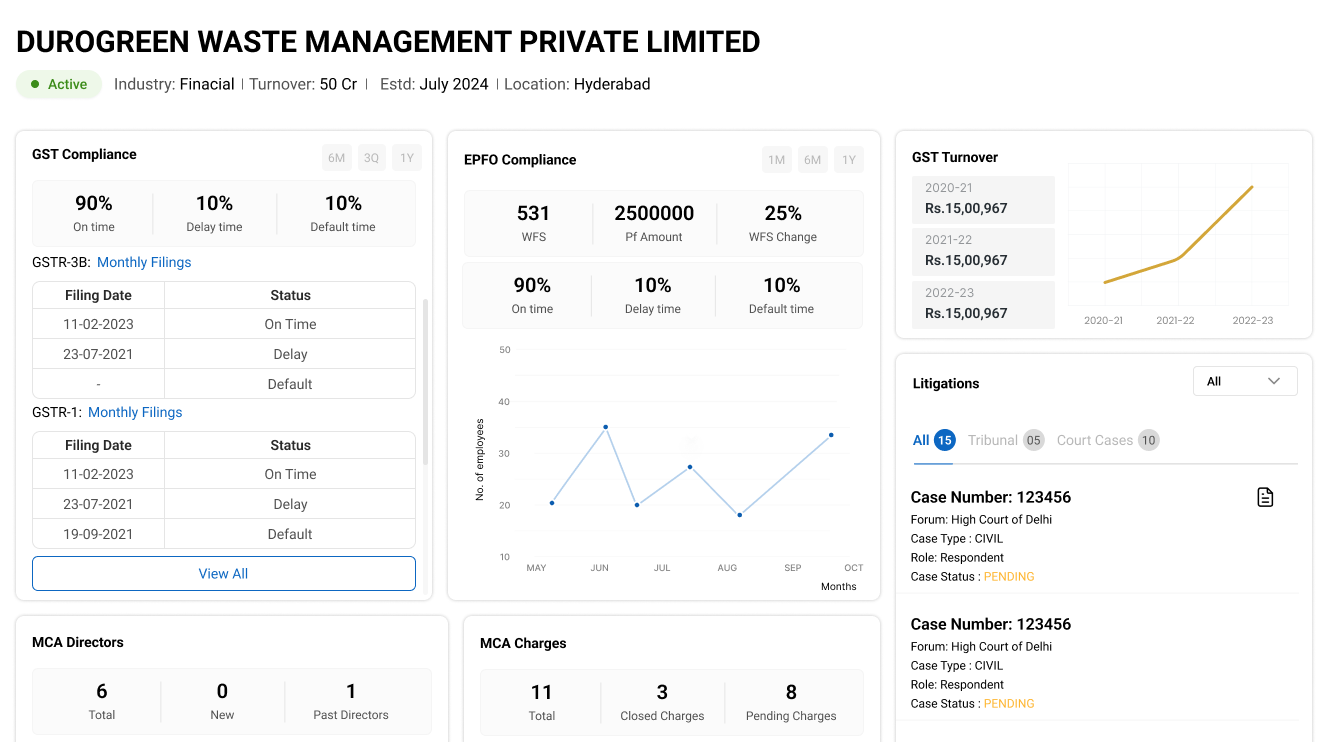

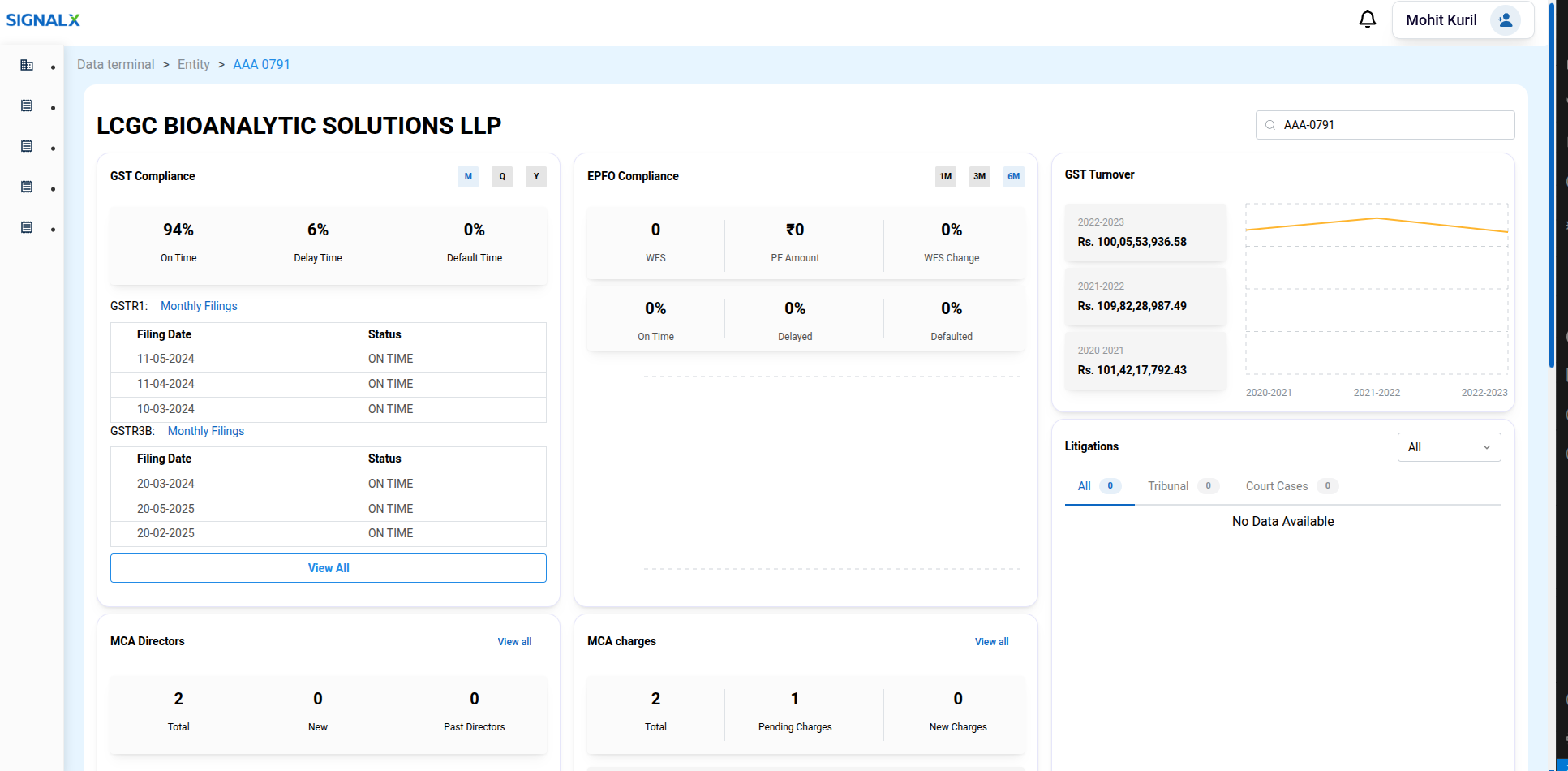

SignalX Risk Terminal is a unified, AI-powered platform that delivers a complete view of an entity’s financial, compliance, and litigation profile in one place. By consolidating data from multiple authoritative sources into a single, intuitive dashboard, it eliminates the inefficiencies of navigating fragmented systems. With advanced analytics, proactive alerts, and natural language search capabilities, organizations can quickly assess risk, monitor compliance, and make well-informed strategic decisions whether evaluating new opportunities, managing portfolios, or ensuring regulatory adherence.

Data Points

Corporate Profiles

Power Your Risk & Compliance Programs with SignalX DART

A purpose-built data platform to supercharge due diligence, risk intelligence, and compliance workflows.

Fragmented Data Sources

Critical risk, compliance, and financial data is often scattered across multiple public and private databases, making it time-consuming and inefficient to compile a complete profile of an entity.Lack of Timely Insights

Without real-time monitoring and proactive alerts, companies risk missing early warning signs of compliance deviations, financial distress, or litigation developments.Inefficient Due Diligence Processes

Manual due diligence across multiple datasets can delay decision-making, increase costs, and leave room for oversight.Difficulty in Targeted Risk Analysis

Inability to filter and analyze entities by relevant parameters such as industry, turnover, geography, or compliance history can lead to missed risks or misaligned evaluations.

Leverage DART to Elevate Risk & Compliance Operations

Proactive Risk Detection: Continuous monitoring with real-time alerts for compliance deviations and emerging risks.

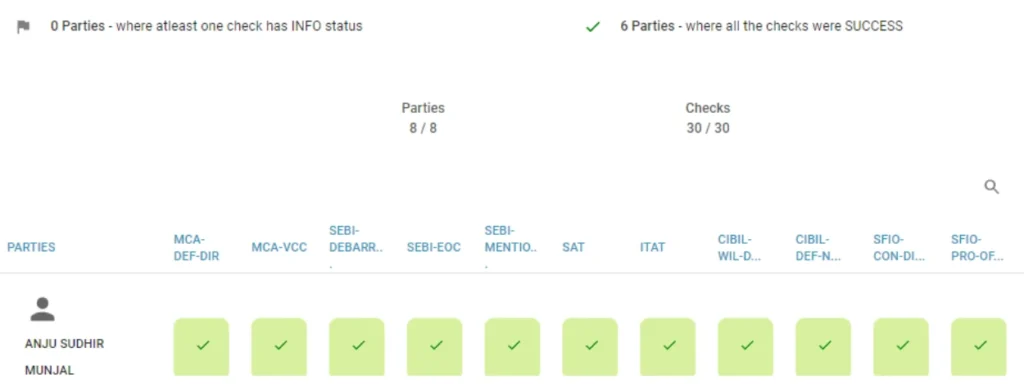

Comprehensive Due Diligence: In-depth checks across financial, litigation, and corporate datasets with risk scoring.

Compliance Tracking: Monitor filing statuses and historical compliance data across multiple regulatory sources.

Targeted Analysis: Advanced filters by industry, turnover, location, and entity age for precise risk focus.

Audit-Ready Reporting: Collaboration tools and exportable reports for audits and regulatory submissions.

Power your risk teams with unparalleled data access

Data Terminal: One Platform. Endless Insight.

Global Reach – 100M+ data points, 35M+ corporate profiles

Historical Snapshots – Track changes and spot red flags early

Datablocks Subscriptions – Pay only for the data you need

Flexible API Access – Seamless integration into your systems

Modern UI – Explore, filter, and export data with ease

Power Smarter Risk & Compliance Workflows

Build sophisticated risk assessment applications

Launch continuous monitoring and early warning systems

Skip the hassle of data lake maintenance

Align data to your specific compliance needs

Streamline procurement with an all-in-one subscription model

Schedule a call with us today to see Risk Terminal in action

Make faster, smarter compliance decisions. Schedule a call and discover how SignalX Risk Terminal centralizes risk data, streamlines due diligence, and keeps you ahead of potential issues.

Accelerate decision-making across due diligence, compliance, and third-party risk programs. The DART platform delivers weeks of research in minutes at scale, with precision, and full auditability.

How SignalX Works

3 step process to supercharge your Resolution Applicant verification process.

Enter RA Name

Input the name of the Resolution Applicant in your console. The system automatically identifies connected or related parties using regulatory and media data in real time.

Expand Network

Access the initial analysis in 48 hours. Review identified parties, add new ones if needed, and get an updated report with all changes within 2 hours.

Investigate RA

Explore the full analysis with supporting data points and source files. Use these insights to make informed IBC 29A eligibility decisions and export documents as needed.

Request a quote today. Let us know your requirements.

Real Stories, Real Results

Kiran Golla

We were referred to use SignalX for 29A eligibility checks and it has been a great decision. The report surpassed our expectations. The format is intuitive and informative, and the platform covers the sources in detail.

Megha Agarwal

SignalX is a fantastic one-stop solution provider. It provided us with all the data required in a short span of time while being cost-effective & providing custom reports.

Santanu Brahma

The platform comes with comprehensive data coverage & analytics, all built into an intuitive interface. Our DD time has reduced to ⅓ of what it would’ve taken otherwise to execute these checks.

Hemanshu Jetley & Samiha Rautela

The detailed connected party study with litigation, finance & media history has been an invaluable addition to our 29A Eligibility checks.

Jagadeesh Kumar

The analysis is extensive & done in record time. SignalX has helped us take automation to the next level.

Manish Jaju

SignalX’s experience with such projects ensured they knew exactly what was required to create a simple yet comprehensive eligibility report, ready for submission to the CoC.

Jigar Bhatt

The team promptly responded, understanding the tight timelines, and delivered the needed analysis in less than 12 hours. CoC members appreciated the detailed checks and due-diligence report presented by RP..

Madhusruthi Neelakantan

We had specific details on each target available at our fingertips. From appeal numbers to court orders - all the data we required was in 1 place. SignalX has helped us cut our Due Diligence cost and time at a very convenient rate.

FAQs

Manually collecting data from multiple sources can take days. A better approach is to use automated tools that gather and analyze public data in minutes saving you time, improving accuracy, and letting your team focus on decision-making instead of paperwork.

Instead of juggling between government websites, court portals, and financial documents, it’s more efficient to use a single system that consolidates everything—company details, litigation history, tax issues, media reports so you don’t miss critical red flags.

Yes. You can look for red flags like unpaid taxes, frequent lawsuits, fraud mentions in the media, or irregularities in filings. Using a system that scans these indicators for you ensures you’re not missing something important during evaluation.

When you’re dealing with a large list of companies or vendors, manual checks become overwhelming. Batch-processing tools allow you to upload all your names at once and get detailed reports for each saving time and effort.

Definitely. Good risk tools let you define what data matters most to you be it legal history, financial compliance, or ownership details and customize reports and workflows accordingly.

Every check you run should be stored with a clear timestamp and summary. That way, when an audit or internal review happens, you have a record of what was checked, when, and what decisions were made ensuring full transparency.

FAQs

Connected parties are defined in IBC (2016) and also the Companies Act 2013. We have explored the definitions in detail here and here. At SignalX, our goal is to be as thorough as possible in connected party identification so that the Resolution Professional has a broad set of entities to include or exclude from the final report. If the target, i.e, the resolution applicant, is an entity, we identify the promoters, associated entities, subsidiaries, key managerial personnel, directors, past directors, shareholders with more than 2% fully diluted shareholding as the level one connected parties.

Other entities where the promoters, directors, KMPs, key shareholders are in management control, promoters and directors and KMPs of associate companies and subsidiaries, the family tree of individuals in level one connected party network form the Level 2 connected party network of the target.

The user can also choose to go further deeper into Level 3 in a similar format. You can talk to our Product Specialist by booking a meeting with us to understand our approach bette

No. However, if you have a list of connected parties provided to you by the resolution applicant, you can share the same with us under a non-disclosure agreement. We can verify and enhance the provided list using our own connected party identification methodology.

Father’s names of promoters, directors, and KMPs are identified from the PAN details wherever available. Details of Mother, Spouse, Siblings, Children, Children of Siblings, Father’s Siblings, and Mother’s Siblings are provided by the user in specific cases where the Resolution Professional wants to be thorough on the eligibility assessment.

Yes. You can use SignalX to analyze entities, individuals, proprietors, consortiums, partnership entities, trusts, and other forms of businesses.

No. We’re an analytics utility and public data research platform that does deep-dive research on any given target. We offer reports in a standardized format that have been directly used across 250+ CIRPs. If the Resolution Professional requires a signed declaration of eligibility or ineligibility of a target, the RP may share our report with any law firm for the same. The complete data dump of the research can be exported along with the report to substantiate the findings.

We pull data directly from thousands of sources including courts, regulators, corporate registry, media, tribunals, law enforcement, watchlist, and more. Connect with us over a call to take a look at the detailed list of data sources we cover in our analysis.

No. We do not interact with the given target in any capacity. The analysis executed is based on data made available by regulators, government agencies, law enforcement agencies, courts, watchlists, and more.

For a target with a connected party network for 20 entities, the entire analysis including the reporting is executed in 48 hours. Thereafter for every 20 additional connected parties, the analysis may take an additional 24 hours.

Yes, we do. For our clients, we have analyzed resolution applicants from countries like Singapore, Mauritius, BVI, UK, Brazil, USA, Ethiopia, and more. You can talk to our sales team to understand the scope of checks we execute in these jurisdictions.

We procure our data directly from the specific regulatory authorities in real-time. Meaning SignalX does not rely on a pre-existing internally stored database but we pull the data fresh for every analysis directly from the source. This allows us to provide the latest litigation, regulatory, and media data for our users, keeping in mind the criticality of the checks we execute.